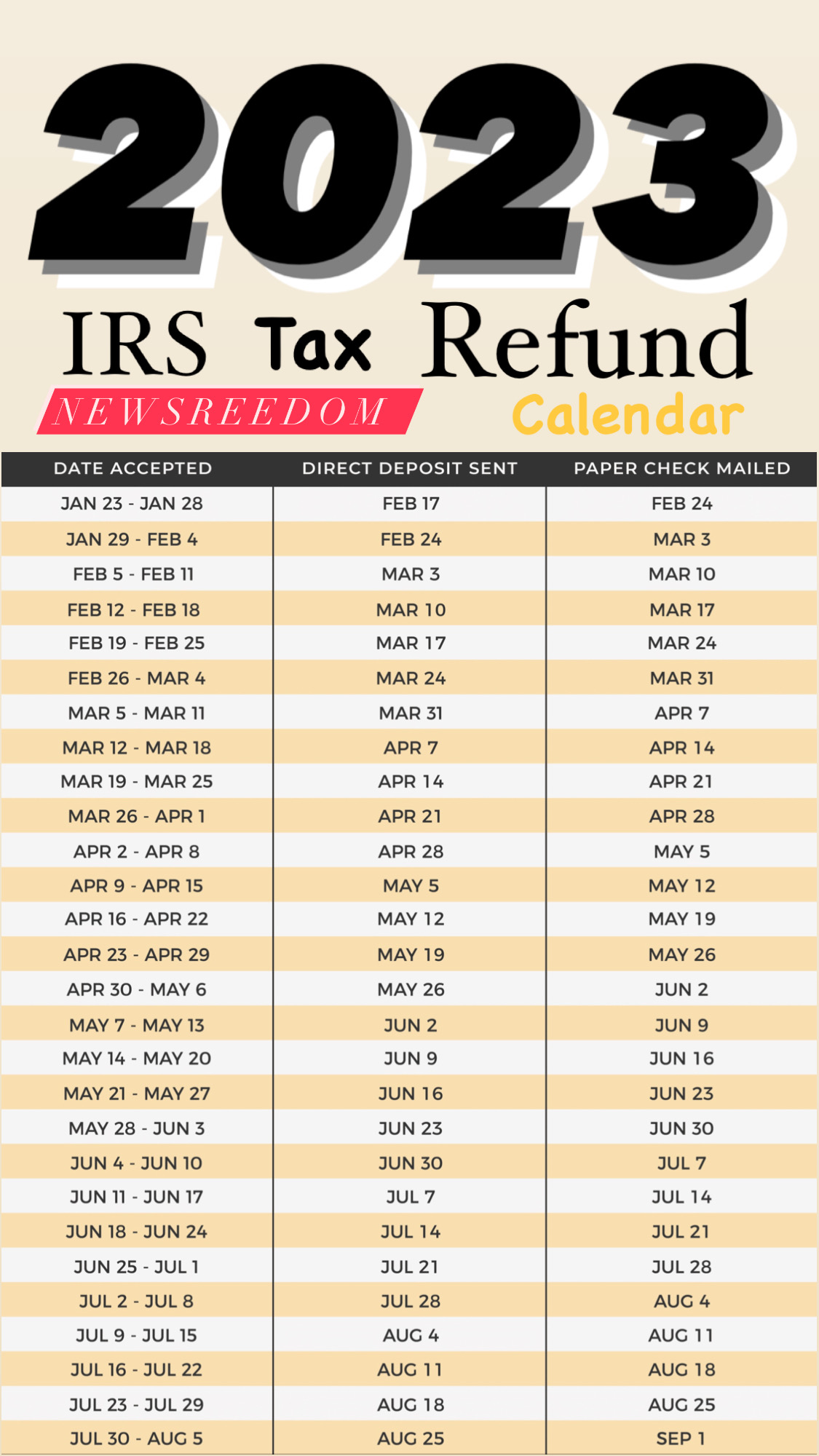

IRS Tax Refund Calendar 2023. When To Expect My Tax Refund?

One of the most pressing questions in the life of an early tax filer- when can I expect my tax refund to come? To predict e-filing is always different. First, you mail in your return. Then someone inputs all your information (and later, computers scanned in your information), then the Treasury had to issue a check, which was then mailed to you. Now, with a free IRS e-file, you can get your refund in as little as 8 days from when you file, if you elect for direct deposit.

IRS issued refunds in less than 21 days from the date the return was received last year, for 9 out of 10 taxpayers.

Early Filers You Will See A Delay In Your Refund

A typically see a delay every year. We’re hoping that this will likely not be as much of an issue this year due to minimal tax code changes, but we could see some curve balls.

Remember, Congress passed a law require the IRS to comply with all the tax refunds this includes the Earned Income Tax Credit (EITC) and the Extra Child Tax Credit (ACTC) by February 15, 2023, no matter how early the tax return filed. So, if you file on the first day, you can wait until February 15 for your refund.

IRS typically provides updates with direct deposit dates, assuming there are no other problems with the tax returns. We expect the actual first direct deposits to arrive the first week of February, similar to previous years.

The goal is to deter fraud and give the IRS time to make sure it’s not duplicate returns are filed. Difficulty is the IRS keep your entire tax refund, not just the EITC or ACTC section only.

When you get a refund, don’t let it go waste! Make sure you get high yield savings account as soon as possible.

Save Your Tax Return

If you would like to receive your tax return faster, check out GO2bank, that make this possible faster money deposits from the government-whether tax refunds or future stimulus checks. You can potentially receive your government payment several days earlier than you normally would. Plus, when you found your new account with your tax refund, you’ll be entered into a $50,000 sweepstakes.

Undelivered Federal Tax Refund

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service (USPS), your refund check may be returned check may be returned check may be returned to the IRS.

If you have not received federal tax refund and you were expecting it, check the IRS ‘Where’s My Refund page. You’ll need to enter your Social Security Number (SSN), filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also call the IRS to check on the status of your refund. Wait times to speak with a representative can be long. But you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a change of Address Form 8822 (PDF, Download Adobe Reader) to the IRS; you should also submit a Change of Address to the USPS.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and don’t file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

- Your qualify for the Earned Income Tax Credit (EITC)

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

IRS2Go offers many features

Make a Payment

Get easy access to mobile friendly payment options like IRS Direct pay, offering you a free, secure way to pay directly from your bank account. You can also make a debit or credit card payment through an approved payment processor.

Refund Status

Check the status of your federal income tax refund using IRS2Go. You can check your refund status within 24 hours after we receive your e-filed return or about four weeks after mailing your return.

Free Tax Help

Get your taxes done and filed. If you prefer receiving help in person, you can find a Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) site near you and receive free tax help. Or, if you can directly access FREE tax software from your mobile device to quickly prepare and file your taxes and get your refund. These programs are available to taxpayers who qualify.